IRS Tax Form W-3

In the United States, the federal tax system has experienced numerous changes and revisions over the years. Still, the IRS tax form W-3 has been a constant element, proving its pivotal role in federal tax reporting. Introduced by the Internal Revenue Service, this form acts as a transmittal record of employees' income and tax data collected through the W-2 forms.

Recent Revisions to the W-3 Tax Form

In line with the ever-evolving tax landscape, several significant amendments have been implemented to the W-3 tax form in recent years. Key among these was the introduction of the W3 2023 tax form, reflecting the IRS's commitment to improving the efficiency and accuracy of tax reporting. Such modifications help to simplify tax filing, thus making tax administration smoother for employers.

Understanding Eligibility for W-3 Form Use

While it's a critical document in the federal tax structure, the IRS tax form W-3 is not designed for use by every taxpayer.

- Primarily intended for employers, this form is applicable to those who have employees from whom income, social security, or Medicare tax was withheld.

- The form also caters to those who would have withheld these taxes if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W-4.

- Those who aren't running businesses or do not otherwise fall under these categories are typically not eligible to print and use this tax form.

Maximizing the IRS W-3 Form Benefits

Just as important as knowing how to print the W3 tax form is understanding how to utilize it for maximum tax benefits. Among the ways to do this include keeping detailed and accurate records throughout the year, which will simplify the process of filing your W-3 form when tax season comes around. It's also crucial to understand the various boxes and lines on the form to ensure all information is correctly reported. This not only helps to prevent potential penalties for inaccurate reporting, but it also offers a clear overview of your tax obligations, aiding you in effective financial planning.

Payment of taxes is a civic duty for everyone generating an income. Understanding the intricacies of the various forms and documentation required in this process is a fundamental part of this responsibility. It's hoped that this guide has provided some valuable insights into the nature and importance of the federal tax form W-3, as well as offered practical suggestions for its effective use.

Latest News

-

![Printable W3 Form for 2023]()

- 7 December, 2023

-

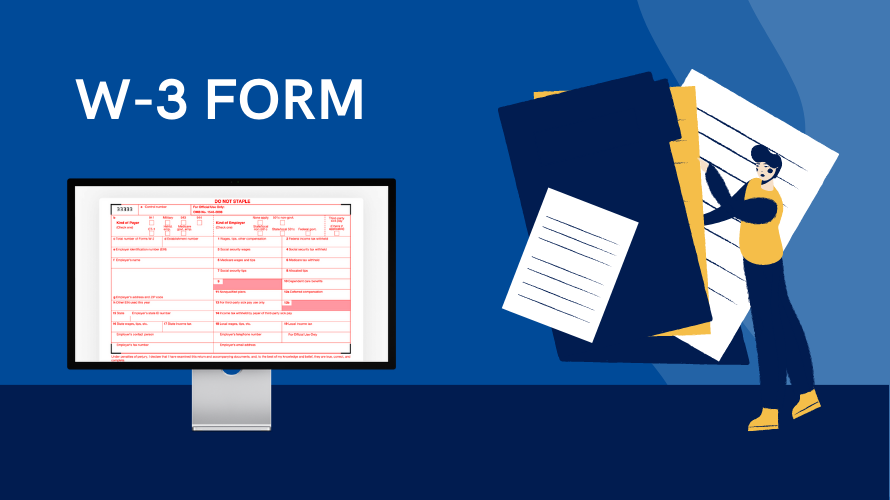

![IRS W-3 Form]()

- 5 December, 2023