W-3 Fillable Form for 2023

IRS W-3 Tax Form for 2023: Explaining All Vital Details

IRS Form W-3, also recognized as the Transmittal of Wage and Tax Statements, is a comprehensive document that is typically used by employers for tax purposes in the United States. It is a summary of all W-2 forms issued to employees throughout the year, detailing total earnings, Social Security wages, federal and state wages, and withheld taxes. Preparation and submission of this federal W3 form to the IRS is mandatory for employers at the end of each tax year.

In the often complex world of taxation, resources like w3-fillable-form.com can prove highly valuable. Our website provides a free W3 fillable form, which simplifies the task of completing the report electronically. It offers detailed instructions, step-by-step guides, and real-world examples that can easily steer you through the form. By using the Form W-3 PDF available on our website, even those who are new to tax matters can understand and fill the document correctly, preventing potential errors and reducing the time spent on this critical task.

Obligation to File the W3 Form

In the realm of taxation in the USA, the W-3 fillable form from the IRS represents a key document for certain individuals and organizations. Essentially, employers who pay remuneration, including noncash payments, to employees for services rendered must fill out this document. Moreover, if you've previously used any W-2 copies, you must also use the W-3 sample.

Example of the Transmittal of Wage Reporting

Introducing John McAdam, an entrepreneur with a small but thriving advertising agency. John hired several creative talents for his agency. In 2022, he paid them wages and other compensations in cash and non-cash assets. After making these payments, he has prepared W-2 copies for each employee, reporting the total amount paid and taxes withheld. Given this situation, John now needs to fill out the W3 transmittal form following his fulfillment of W-2 obligations for employees.

Now, why is it necessary for John to take this extra step? Despite the extra work, filing the 2023 W-3 fillable form is crucial to validating the W-2 examples he submitted. Simply put, the W-3 example summarizes or consolidates all the W-2s, helping the IRS cross-check and verify its records. In short, if you've used any W-2s just like John McAdam, the W-3 form should not be overlooked. It ensures you remain in the good graces of the IRS, free from any potential pitfalls and trouble down the line.

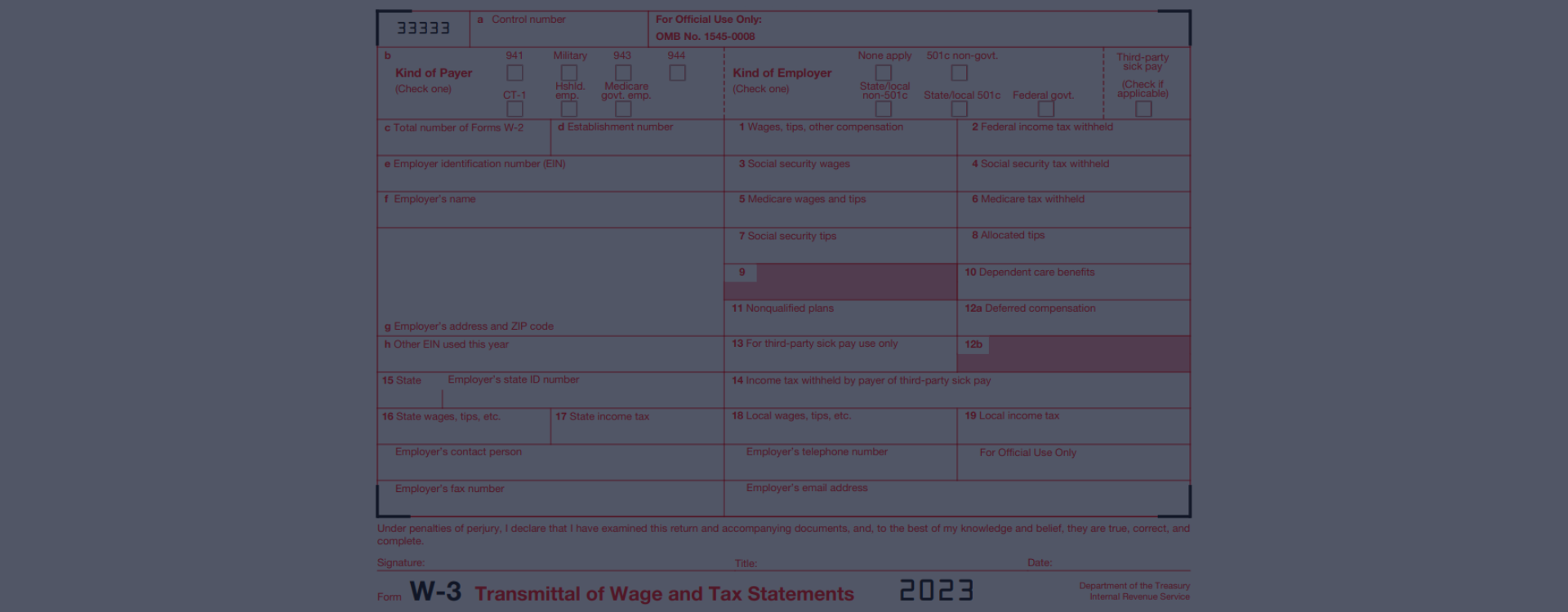

Steps to Fill Out the W-3 Tax Form in PDF

Understanding and correctly filling out the fillable Form W-3 for 2023 is crucial to accurate taxation. This official transmittal record of wage and tax statements often confuses people. Here's a simplified guide and the main benefits of the online filling method.

File IRS Form W-3 on Time

As the fiscal season approaches, it is crucial to be aware of important details relating to the filing of your federal tax documents. In particular, the fillable W-3 form for 2023 must be submitted by January 31, 2024, to the SSA. To avoid any late filing disputes, it's highly recommended to file Form W3 online. This modern and simple method provides the added benefits of timely submission and receipt confirmation.

Tax Form W3 & IRS Penalties

It is important to note that there are certain penalties associated with failing to file on time or submitting false or misleading information. The former could leave you faced with a monetary fine, while the latter could lead to serious legal actions. Hence, it is always best to ensure timely and accurate filing to avoid such unnecessary issues.

W-3 Transmittal Form: Frequently Asked Questions

Federal Tax Form W-3: Instructions & Examples

Please Note

This website (w3-fillable-form.net) is an independent platform dedicated to providing information and resources specifically about the federal W-3 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.